Beware of COVID-19 Cyber Scams

April 13, 2020

Ministries are creatively scrambling to continue their operations and safely engage their congregations with an array of online technologies during the coronavirus pandemic. From working remote to live streaming Bible studies and services, it’s safe to say most ministries are relying on web-based programs more than ever.

Unfortunately, hackers are ready to take advantage of the confusion with scams designed to steal valuable data or siphon funds from your ministry.

How to Prevent this?

There are many precautions which can be taken to avoid this type of a loss. For example, if in doubt about the validity of a request, you can pick up the phone and call the person who you think is making the request and ask them to confirm it verbally. To learn more about to how protect your ministry against claims like these, check out Brotherhood Mutual’s new article, “Coronavirus: Beware of Cyber Fraud,” and another one that speaks to the issue of fake emails, “Stop the Thief In Your Inbox.”

Claim Example

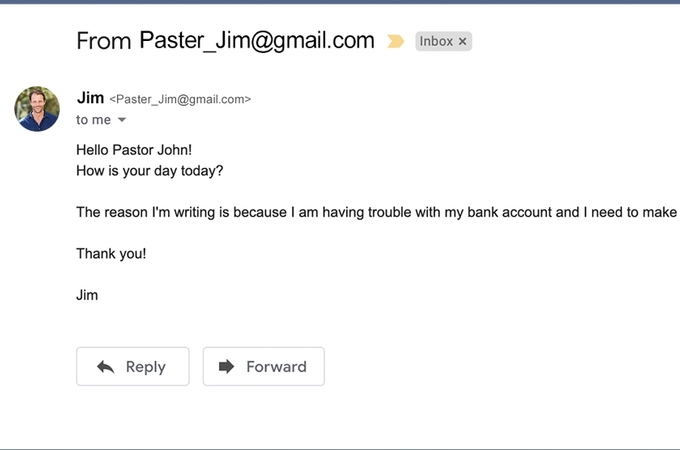

A criminal creates an email that appears to be coming from the new executive pastor of the church. The criminal sends the church business manager an email that says the pastor is switching bank accounts and would like his paycheck EFT’d into the new account. While this is generally something that would be discussed in person, this is not possible now due to COVID-19. The business manager reluctantly complies with the request, even though something doesn’t “feel right” about the email. In addition, the business manager doesn’t want to frustrate the new boss. Once the “submit” button is hit, the money is gone.

Is My Ministry Covered?

There are varying degrees of risk tolerance regarding this type of exposure. To many, it can feel like something like this would never happen. However, we have seen increasing instances of this very type of theft, as criminals continue to use more sophisticated ways to victimize organizations. What if you have taken reasonable precautions, but a criminal still finds a way to persuade someone in your ministry to send funds to him? Will your insurance policy cover this type of loss? Under most theft insurance coverage forms, there is a provision which excludes “voluntary parting” with money. The funds were not stolen, they were voluntarily sent to the fraudulent party, albeit under false pretenses. Due to this exclusion, these claims would not normally be covered.

Brotherhood Mutual has created a coverage that directly addresses this exposure. It’s called “Theft by Coercion.” It does not include the “voluntary parting” exclusion, so it is intended to cover losses like the one described above.

Our purpose with this blog post is simply to educate you about what our agency is seeing. We would like to give you an efficient way to check on this coverage and add it to your policy. Please click here to reach out to our service team to add the coverage or inquire further and we would be happy to help you.

- May 14, 2024

- Documenting an incident: Essential information you need to capture.

-

-

Of all the liability claims that Brotherhood Mutual pays out each year, bodily injury and medical claims are at the top of the list. If your ministry hasn’t experienced a slip-and-fall incident resulting in an injury, it is just a matter of time until you do.

- May 14, 2024

- Have you reviewed your Governance Documents?

-

-

For most churches, and many nonprofits, the end of the school year signals the end of the ministry year. Many of those same churches and nonprofits have fiscal year ends as of June 30. This is a great time to review what is commonly called your organizational “governance” documents.

- May 14, 2024

- Can Claims Be Avoided?

-

-

As I sit here in Kansas watching the news and reports of severe weather in my State and those States that surround me, I must remind myself, “there is not much I can do about this.” As a “fixer” this is difficult for me. The storms are going to roll in and at least we have the weather service who helps prepare us to “stay out of the way.” To answer my own question, we cannot avoid weather related claims.

- May 14, 2024

- From the Exiled Nigerian Prince to a Trusted Vendor: It's Time to Pay Attention to Cyber Threats

-

-

Remember the days when hackers were imagined as shadowy figures living in their parent's basements, playing video games, and eating Doritos while crafting scam emails? Well, that image is now outdated. The world of cybercrime has evolved, and it's both sophisticated and terrifying. According to a recent annual cyber claims report from an insurance carrier called, Coalition, the Federal Bureau of Investigation (FBI), received more than 880,000 complaints of cybercrime in 2023 with reported losses of $12.5 billion.

- April 11, 2024

- Mission Trip Fundraising

-

-

If your church or nonprofit engages in short-term, summer mission trips, this time often signals the beginning of fundraising projects. Before you appeal for donations, it is important to review the rules of what the IRS calls “deputized fundraising” making sure you have the proper policies and procedures in place to maintain compliance. Failure to maintain compliance could result in the loss of your tax-exempt status.

- February 19, 2024

- Is Your Facility Use Agreement Working For You?

-

-

With Valentine’s Day upon us and the official May-to-October wedding season not far behind, many couples are searching for the perfect wedding venue. Schools and performing arts organizations are looking for end-of-year performance and graduation venues. Your church or nonprofit facility might be the perfect match. Engaging the opportunity has stewardship and community outreach benefits. But opening your facilities to other activities and users involves risk. A Facility Use Policy sets the standard for your facility use. A Facility Use Agreement implements that standard. To be effective, leaders must answer three questions.

- February 19, 2024

- PART TWO: How protected are members of your safety team? The answer may surprise you.

-

-

The focus of this article is to address some of the risks and liabilities associated with having an armed safety team. Click here to read PART ONE.

- February 19, 2024

- Client Success Advisors at your Service!

-

-

Over the last few years, our agency has continued to grow and expand across the Midwest & Rockies, now spanning six states: Nebraska, North Dakota, South Dakota, Kansas, Colorado, and Wyoming. Serving over 3,000 ministries and nonprofit organizations, we are deeply grateful for the opportunity to support you.

- February 19, 2024

- 5 Predictions on What is Going to Happen in 2024's Church Insurance Market

-

-

Do you ever feel like some words just get overused? I do. I live in a house with two teenagers and a sweet little boy who watches everything they do. The word "literally", gets used in 80% of sentences... It isn't even impactful anymore. It means nothing. Because if they didn't use that word, I would just expect that most of what they were saying was metaphoric in nature.

- January 12, 2024

- Worker Classification Risk: Employee v. Independent Contractor

-

-

The new year signals the end of one payroll year and the beginning of another. As you process employee W2s and independent contractor 1099s, take time to evaluate a critical aspect of your ministry business risk management program: proper worker classification. While the percentage of the American workforce comprising “contingent workers” (independent contractors, contract employees, temporary employees, leased employees) was rapidly increasing before COVID, since COVID and the acceptance of the remote workplace, use of contingent workers has skyrocketed. You probably have several on your payroll.

- January 12, 2024

- How protected are members of your safety team?

-

-

Over the last few years, I have had the opportunity to speak with several thousand church safety team members across the country. By far the most common question I get from this group is “Am I covered if something bad happens?” This is not a question that only pertains to armed safety team members. Truth is, anyone who serves in the protection of a ministry should be asking that question. The purpose of this article is to help ministries be better informed and more prepared in advance of an incident occurring.

- January 12, 2024

- Stay Ahead of the Freeze: Sign Up for Text Alerts

-

-

We’re encouraging all customers to stay ahead of the freezing weather by signing up to receive Extreme Freezing Weather Text Alerts from Brotherhood Mutual. It’s new. The alert also links to actions you can take immediately to prevent or minimize damage to your buildings before forecasted weather arrives.

- January 12, 2024

- There's Something for Everyone at this Year's 2024 Ministry Boot Camp!

-

-

Join us for a comprehensive, one-day training for all! Tailored breakout sessions cover complex HR topics for administration and provides in-depth training, including a deeper review into de-escalation, for the security team. In the afternoon, unite in a deep dive on child safety with proprietary insights the anatomy of an abuse claim and protecting our youth.

- December 20, 2023

- Wishing you a Merry Christmas – 80s Style

-

- November 7, 2023

- Three common pitfalls that may be hidden in your church's lease

-

-

One positive aspect of today’s challenged economy is the availability of underutilized or empty commercial space. Before your ministry takes the plunge into a lease agreement, we want to make sure you're well-informed and prepared to avoid some common pitfalls.

- November 7, 2023

- Insurance Companies Are Forced To Respond To Unprecedented Market Strain. What Does This Mean For You?

-

-

In this month's perspective on the insurance market, I wanted to talk about the massive upward trending we are seeing in cancellation of policies. Our agency has observed a remarkable surge in inquiries from churches not currently under our insurance coverage. These churches are facing non-renewal by their existing carriers, a trend that has expanded beyond the norm of non-renewals due to excessive losses. Instead, carriers are now opting not to renew based on the risk profile of the ministry, which encompasses factors like geography, insured value, and construction type.

- November 7, 2023

- Umbrella for a Rainy Day

-

-

There are so many insurance policies to consider when it comes to protecting your ministry, and keeping track of each one’s coverages can be a mind-numbing task. One that I often hear confusion about is the Excess Liability policy, more commonly referred to as an Umbrella. While these terms aren’t exactly interchangeable in the broader insurance world, they do have a lot of overlap. For purposes of understanding your Brotherhood Mutual policy, they are basically synonymous.

- October 6, 2023

- The Crucial Role of Key Man Life Insurance for Church Pastors

-

-

In recent times, our team has observed a growing demand for key man life insurance, particularly within the realm of church leadership. Pastors are the spiritual pillars of their congregations, providing guidance, support, and a sense of community. While their spiritual contributions are invaluable, it's equally important to consider their financial well-being and the stability of the church should an unforeseen tragedy occur.

- October 6, 2023

- Wellbeing Resources for Ministry Leaders

-

-

The holiday season is fast approaching, and it's time to prepare for the festive cheer, delicious food, twinkling lights, and heartwarming gatherings. But amidst all the joy and celebration, let's take a moment to reflect on something essential - the well-being of our ministry leaders.

- October 6, 2023

- Stop Plumbing Leaks with FloLogic

-

-

Water damage due to plumbing leaks and frozen pipes is a leading cause of property claims for ministries. The damage is often made worse because ministry buildings are typically not in use every day. Last year, nearly 1,000 Brotherhood Mutual Insurance Company customers were impacted. To help protect ministries from experiencing costly water damage and disruptions, Brotherhood Mutual® recommends FloLogic, a comprehensive solution that can detect even the smallest water leak and automatically shut off the water to prevent flooding.